Lecturer in Economic Sociology, Department of Sociology, University of Edinburgh

Ph.D. 2012, Department of Sociology, The University of Wisconsin-Madison

I am a comparative economic and political sociologist with interests in social networks, development, organizations, globalization, the sociology of knowledge and professions, and sociological theory. My empirical research centers on elite political networks and the economic sociology of financial institutions, particularly in Latin America.

I am a comparative economic and political sociologist with interests in social networks, development, organizations, globalization, the sociology of knowledge and professions, and sociological theory. My empirical research centers on elite political networks and the economic sociology of financial institutions, particularly in Latin America.

Technocratic elites and state capacity

The production of money is one of the core economic tasks of the state in contemporary economies. Yet in many developing countries, governments have failed to perform this fundamental role effectively, reflecting a deficit of state capacity in their financial institutions. My book project, “Power and Pesos: Bureaucratic Elites and the Politics of Money in Mexico and Argentina,” examines monetary stability and instability in the developing world in order to illuminate the basis of state capacity in elite cooperation and conflict. I compare Argentina, a country that has long failed to sustain a stable monetary system, and Mexico, which has achieved relative stability in recent years. I argue that these contrasting outcomes can be traced to persistent elite fragmentation and factionalism in Argentina, while the emergence of a cohesive elite in Mexico has promoted stability – albeit at a price. I illustrate the structure of elite networks and the consequences of this structure in “Cohesion, Consensus and Conflict: Technocratic Elites and Financial Crisis in Mexico and Argentina" (2015; Honorable Mention for the Burt student paper award from the economic sociology section of the ASA).

Elite coalition formation

My findings regarding the impact of elite policymaking networks on state capacity have led to a more general set of questions regarding political networks. A longstanding tradition in sociology attributes state capacity to the robust institutionalization of “Weberian” bureaucracies, but also recognizes that informal interpersonal networks play a key role in shaping political institutions. Yet these elite networks and their impact have rarely been studied directly. In my working paper “Brokers, Clients and Elite Political Networks in Mexico” I address this deficiency using an original dataset which records the career histories senior Mexican political elite over a seventy year period, a significant improvement over previous data sources. Using these unique data to infer the structure of elite political networks over a long time period, I study the influence of network position on elite political careers. I find that both patronage ties and brokerage positions at the top of the state hierarchy, both confirming (with important qualifications) longstanding but untested hypotheses about the role of elite patronage and contributing to the understanding of the context in which brokerage matters within network theory. In the Mexican context, these findings imply that patronage appointments are not as antithetical to state capacity as often assumed, and that elite political brokers may contribute to state capacity by helping maintain elite cohesion. I am also in the preliminary stages of research on the formation, evolution and dissolution of elite coalitions in Argentina using legislative cosponsorship networks.

The June 2015 comparative political networks conference in Madrid, organized by myself and John Levi Martin, brought together a range scholars from sociology and political science working on networks in the traditions of comparative political economy and comparative-historical sociology.

Organizations, expertise and policy-making

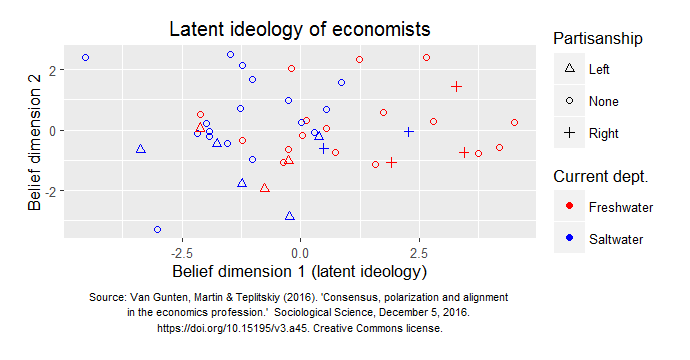

Monetary and financial policy are often delegated to bureaucratic experts (such as professional economists like Federal Reserve chairwoman Janet Yellen) insulated from partisan politics, often on the assumption that impartial experts will make better policy decisions than elected politicians. But how much influence do such experts really have, and do professions like economics really deliver neutral expertise? These questions are addressed in several published papers, including: “Cycles of Polarization and Settlement: Rethinking the Dynamics of Change in the Macroeconomic Policy Field” (Theory and Society, 2015) and “Washington Dissensus: Ambiguity and Conflict at the International Monetary Fund” (Socio-Economic Review 2016; general interest summary). In "Consensus, polarization and alignment in the economics profession" (Sociological Science, with John Levi Martin and Misha Teplitskiy) I show that there is a clear structure of ideological alignment in economists' public policy views. Our results refute previous widely-discussed research published in the American Economic Review which claimed that there is no detectable ideology in economists' policy views, using the same data. These findings were summarized on the Washington Post's Monkey Cage blog.

Monetary and financial policy are often delegated to bureaucratic experts (such as professional economists like Federal Reserve chairwoman Janet Yellen) insulated from partisan politics, often on the assumption that impartial experts will make better policy decisions than elected politicians. But how much influence do such experts really have, and do professions like economics really deliver neutral expertise? These questions are addressed in several published papers, including: “Cycles of Polarization and Settlement: Rethinking the Dynamics of Change in the Macroeconomic Policy Field” (Theory and Society, 2015) and “Washington Dissensus: Ambiguity and Conflict at the International Monetary Fund” (Socio-Economic Review 2016; general interest summary). In "Consensus, polarization and alignment in the economics profession" (Sociological Science, with John Levi Martin and Misha Teplitskiy) I show that there is a clear structure of ideological alignment in economists' public policy views. Our results refute previous widely-discussed research published in the American Economic Review which claimed that there is no detectable ideology in economists' policy views, using the same data. These findings were summarized on the Washington Post's Monkey Cage blog.

Household debt, wealth and the global financial crisis

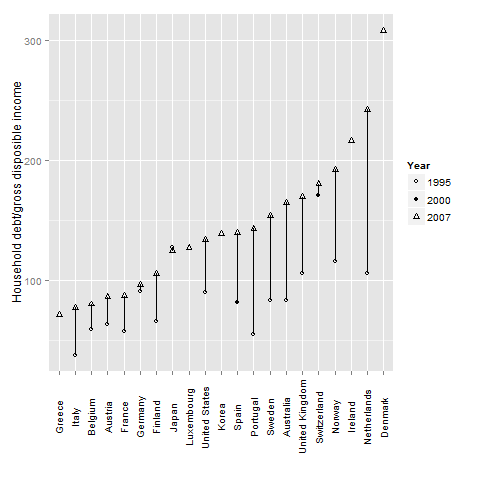

While many scholars argue that high levels of household debt is a unique feature of the U.S. political economy, household debt has reached higher levels in European countries as diverse as Denmark, the Netherlands, Ireland, Portugal and Spain. Meanwhile, debt has remained comparatively moderate in other countries, such as France and Germany. Why did homeowners take on so much debt in some European countries, contributing to financial collapse, and not others? My paper “Varieties of Indebtedness: Financialization and Mortgage Market Institutions in Europe” (Social Science Research; coauthored with Edo Navot) examines financial inclusion, extension and intensity as explanations for cross-national variation in debt levels. We argue that inclusion -- greater access to homeownership -- plays a surprisingly small role in explaining debt levels, while financial intensity -- households borrowing more relative to income -- deserves more attention. Banks enable households to borrow more relative to income by relaxing lending conditions such as mortgage duration and refinancing, which are tied in turn to the national configuration of mortgage markets.

While many scholars argue that high levels of household debt is a unique feature of the U.S. political economy, household debt has reached higher levels in European countries as diverse as Denmark, the Netherlands, Ireland, Portugal and Spain. Meanwhile, debt has remained comparatively moderate in other countries, such as France and Germany. Why did homeowners take on so much debt in some European countries, contributing to financial collapse, and not others? My paper “Varieties of Indebtedness: Financialization and Mortgage Market Institutions in Europe” (Social Science Research; coauthored with Edo Navot) examines financial inclusion, extension and intensity as explanations for cross-national variation in debt levels. We argue that inclusion -- greater access to homeownership -- plays a surprisingly small role in explaining debt levels, while financial intensity -- households borrowing more relative to income -- deserves more attention. Banks enable households to borrow more relative to income by relaxing lending conditions such as mortgage duration and refinancing, which are tied in turn to the national configuration of mortgage markets.

One key reason that banks expand mortgage lending is the existing of financial technologies, such as mortage securitzation, that reduce the appearance of risk and contribute to "exuberance" about financial and housing market conditions. I am currently studying this dynamic in the Spanish case, using original bank-level data on mortgage securitization and network autocorrelation models to study the diffusion of lending behavior during the mortgage boom in the savings bank sector. I am also using Spanish household wealth microdata so study the dynamics of wealth inequality over the boom-bust housing cycle.

In 2016, I co-organized workshops on household wealth and securitization, hosted at MaxPo in Paris and the Max Planck Institute for the Study of Societies in Cologne, Germany.